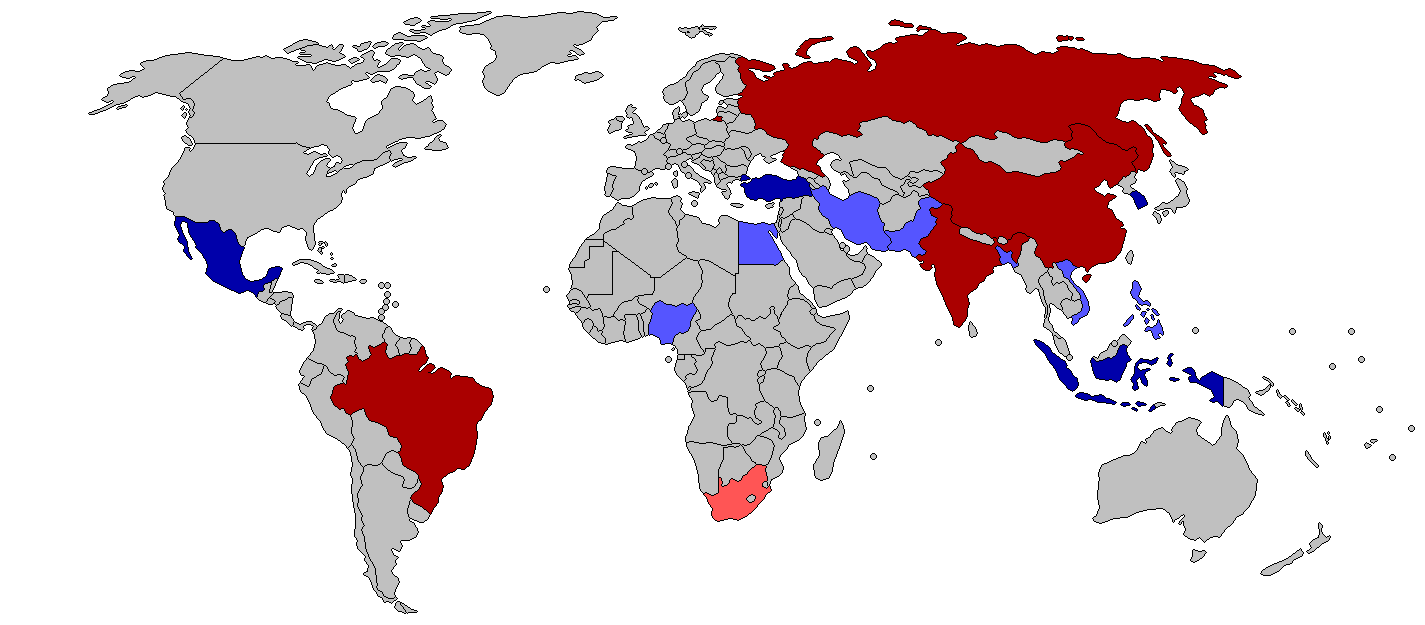

The BRICS bloc and the ‘Next Eleven’*

Introduction: The Challenges

The BRICS phenomenon that started life as a Goldman Sachs’ concept for emerging or rising economies shifted to a formal institutional status in 2006 of four countries: Brazil, Russia, India, China, and later five countries with the addition of South Africa four years later. In 2015, it established the multilateral New Development Bank (NDB) with some $100 billion in capital and four new members taking up shares (Egypt, United Arab Emirates, Bangladesh, Uruguay). Over the period since its establishment to the eve of its 15th Summit in South Africa (August 20–24, 2023), many commentators have discussed the ‘rise of BRICS’ in terms of a ‘new world order’ that offers an alternative to the Western-dominated order exemplifying a new form of development different from the neoliberal World Bank and IMF structural adjustment model. Yet, as Astrid Prange notes, ‘Predictions about the BRICS countries as the fastest growing economies haven’t quite panned out. Instead, the alliance is now offering a diplomatic forum and development financing, outside of the Western mainstream.’

Does BRICS really provide a Global South alternative to the G7 forum of advanced economies? Is this the BRICS geopolitical moment in world history when the US, perceived as a declining hegemon, is prosecuting an expanding trade, tech and financial war with China? Does the new intergovernmental cooperation and display of soft power in the WTO, the UN and sister organisations mean that the US will simply turn away from these world institutions to pursue a unilateral future tantamount to all-out economic war with the attendant risk of great power conflict? Have some of the world’s fastest-growing (‘emerging’) economies stalled, and the BRICS instead become a diplomatic forum and intergovernmental development agency for the Global South? Critical to answering these questions is an assessment of the success of establishing new MDBs (multilateral development banks), not only the NDB but also the Asian Infrastructure Investment Bank (AIIB) proposed in the same year (2015) and the Shanghai Cooperation Organisation (SCO) Development Bank that is still not operational. Hooijmaaijers, comparing and contrasting the success and failure of establishing new MDBs, including interbank linkages between NDB and AIIB, and cooperation with other MDBs and other financial institutions, suggests that BRICS ‘efforts to establish new institutions have had mixed results.’

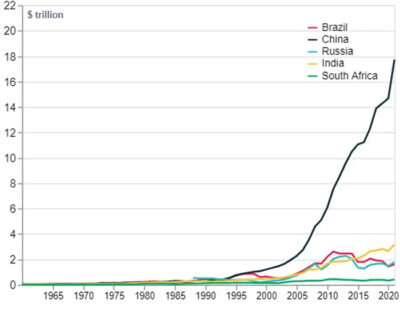

Yet, in less than twenty years, the BRICS has certainly made its presence felt in multiple policy spheres, financial assistance, economic development and strategic geopolitics. It increasingly serves as a club that best represents and articulates the interests of the Global South after centuries of Western colonisation and exploitation. Climate change convergence is also a new policy area that has experienced BRICS convergence on climate change. Both population and GDP predictions indicate that while rates have not been uniformly even, they are climbing and serve as indicative evidence of a rapidly increasing share of world resources, as the World Bank statistics reveal, even if by far the greatest increase has been by China. It is also the case now that the BRICS, except for China and India, are not ‘emerging economies’: Brazil has faltered, and Russia has experienced negative growth, and other economies, including Saudi Arabia and other oil-rich states such as Bahrain, Kuwait and Iran, and ASEAN-5 countries (Thailand, Malaysia, The Philippines, Singapore, Indonesia) are now deemed ‘emerging.’ Goldman Sachs refers to ‘The Next Eleven’ (N-11) as Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, Turkey, South Korea and Vietnam as those countries that have BRICS-like potential.

Figure 1. GDP by BRICS country.

In the post-liberal international order, US hegemony is declining, and BRICS both crystallises and channels the call for a fairer and more representative world order. In a serious sense, the geopolitical changes in the promise of BRICS indicate a historic transition away from the colonial capitalist model to a more multipolar world, even if, in the shorter term, it exacerbates the risks of American isolationism and an intensification of trade-tech and financial war that could easily spill over from competitive system rivalry to armed conflict. The decentring of US hegemony is fracturing the liberal global monetary order and dollar reserve system with US retaliatory financial warfare and the weaponisation of the dollar to halt RMB internationalisation and BRICS’ ‘cross-border currency use’ that is leading to increasing de-dollarisation and reduced dollar dependency (Chin, 2023). The BRICS are actively promoting a more diversified international monetary system favouring local currency use.

Much depends upon the outcomes of strategies of competitive system rivalry and various US pacts and alliances to ‘contain’ China and slow its economy, but also on questions and issues of internal organisation and decision-making such as the status of Russia in the post-Ukraine war and the level of strategic cooperation between China and India. Also relevant to these concerns are the world-system consequences of a set of global overlapping crises (cost-of-living, pandemic, climate change, ecological collapse, financial crisis, etc.) that form the global assessment risk assessment landscape and their possible resolution through frameworks such as global public goods that depend on greater cooperation among states. Of interest in this regard, too, is the critical role of people-to-people exchange institutions in science, research on key digital technologies and international education that promote great interconnectivity, openness and the digital knowledge economy.

BRICS Summits

The BRICS India 2021 website records the first meeting of BRICS ‘in St. Petersburg, Russia, on the margins of G8 Outreach Summit in July 2006’ becoming formalised in September 2006 at a meeting of the 1st BRIC Foreign Ministers’ Meeting that took place at the United Nations in New York. The first BRICS summit was held in Yekaterinburg, Russia, on 16 June 2009. South Africa attained full membership at the BRIC Foreign Ministers’ meeting in New York in September 2010, alongside the established membership of Brazil, Russia, India and China.

BRICS summits have occurred every year since 2009, and South Africa will host the 15th BRICS Summit on August 22–24 with attendance of heads of state and first ministers and nearly leaders across Africa, Latin America, Asia and the Caribbean as well as the heads of the UN, African Union Commission and the New Development Bank, and business leaders. At this summit, member states will discuss the expansion of BRICS and the criteria for new membership. It is reported that ‘Twenty-three countries have formally applied to become new BRICS members, including Saudi Arabia, Iran, United Arab Emirates, Argentina, Indonesia, Egypt and Ethiopia.’ Other issues on the agenda will include critical infrastructure development, trade expansion and the avoidance of sanctions on Russia, and South African energy development. China and India will likely focus on cross-national security coordination and development financing in competition with Western-dominated financial institutions such as the International Monetary Fund. Brazil will pursue its climate change agenda, including combating deforestation, after the success of the summit of the Amazon Cooperation Treaty Organisation (ACTO) and will also pursue closer multilateral trade with member countries.

Several states from the oil-producing Middle East are seeking membership, which would greatly strengthen the BRICS economic interests. No doubt there will be dialogue and cooperation over political and security issues given the heightened geopolitical tensions between the US and China, and also the encouragement of people-to-people exchanges at all levels. As the BRICS India 2021 site indicates, on the basis of World Bank data 2019, ‘BRICS is an important grouping bringing together the major emerging economies from the world, comprising 41% of the world population, having 24% of the world GDP and over 16% share in the world trade. BRICS countries have been the main engines of global economic growth over the years.’ The BRICS countries established the New Development Bank in 2015 as a ‘multilateral development bank aimed at mobilising resources for infrastructure and sustainable development projects in BRICS and other EMDCs’ (emerging markets and developing countries). The Bank includes governors from all member countries that include BRICS countries and, in addition, Bangladesh, United Arab Emirates, Uruguay and Egypt.

Origin of the Concept with Goldman Sachs

The BRIC acronym originated in a Goldman Sachs paper, ‘Building Better Global Economic BRICs.’ Jim O’Neill’s game-changing paper indicated:

- In 2001 and 2002, real GDP growth in large emerging market economies will exceed that of the G7.

- At end-2000, GDP in US$ on a PPP basis in Brazil, Russia, India and China (BRIC) was about 23.3% of the world GDP. On a current GDP basis, BRIC share of world GDP is 8%.

- Using current GDP, China’s GDP is bigger than that of Italy.

- Over the next ten years, the weight of the BRICs and especially China in world GDP will grow, raising important issues about the global economic impact of fiscal and monetary policy in the BRICs.

- In line with these prospects, world policymaking forums should be re-organised, and, in particular, the G7 should be adjusted to incorporate BRIC representatives.

A second paper, ‘Dreaming with BRICs: The Path to 2050,’ indicated ‘[h]ow BRICs will shape the next 50 years’:

- Over the next 50 years, Brazil, Russia, India and China – the BRICs economies – could become a much larger force in the world economy. We map out GDP growth, income per capita and currency movements in the BRICs economies until 2050.

- The results are startling. If things go right, in less than 40 years, the BRICs economies together could be larger than the G6 in US dollar terms. By 2025they could account for over half the size of the G6. Of the current G6, only the US and Japan may be among the six largest economies in US dollar terms in 2050.

- The list of the world’s ten largest economies may look quite different in 2050. The largest economies in the world (by GDP) may no longer be the richest (by income per capita), making strategic choices for firms more complex.

These Goldman Sachs papers, based on economic modelling ‘to forecast global economic trends over the next half-century, found that the BRIC countries collectively would play an increasingly important role in the global economy.’ Brazil, Russia, India and China established BRIC in 2009, and the bloc became BRICS when South Africa was admitted in 2010.

IN 2007, Goldman Sachs released a collection of papers, BRICS and Beyond, that indicated that

these countries’ equity markets have seen a remarkable increase in their value: Brazil has risen by 369%, India by 499%, Russia by 630%, and China by 201%, using the A-share market, or by a stunning 817% based on the HSCEI.

In 2011, Goldman Sachs’ market intelligence reported the steady climb of BRICS countries in the global rankings:

China moved past Japan to become the world’s second-largest economy. Brazil passed Spain and Italy to become the seventh-largest economy, and is now fast approaching the UK. India and Russia both jumped over Spain to move into ninth and eleventh positions, respectively. Notably, the BRICs’ positions look even more favourable if we instead compare countries’ GDP using PPP exchange rates. While we have long expected the BRICs to catch up with the majority of developed countries eventually, these shifts are happening even quicker than we envisaged.

Jim O’Neill, now a cross-bench peer in the UK House of Lords, in ‘The Future of the BRICS and the New Development Bank,’ reflects on what has transpired with the BRICS since he invented the acronym twenty-one years ago. He writes as follows, in the conclusion:

BRICS expansion would not only be sensible but should be welcomed by all, including the traditional powers, if BRICS Plus and an expanded NDB can work to benefit the greater global good. In summary, to achieve this objective, and for determining which countries should gain membership in the BRICS Plus, I would suggest the following be considered, and for the BRICS countries and prospective new members to reach an agreement: first, what are the specific ambitions, if not targets, for the BRICS Plus in terms of their economic growth; second, what is their specific collective target for reduction of the use of fossil fuels and climate change ambitions and third, what is their combined collective ambition for health challenges, specifically for the further eradication of malaria, TB and their plans to combat anti- microbial resistance?

Perhaps more important is his remark, ‘the US dollar plays a far too dominant role in global finance,’ which has remained dominant in a world in which its economy has relatively diminished. Speaking from his years in international finance, he remarks:

Almost like clockwork through economic cycles, this has meant that whenever the Federal Reserve Board has embarked on periods of monetary tightening or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic for each dollar of dollar-denominated debt of other countries, and destabilising for their monetary policy, and much bigger than the effects of their own domestic decisions.

‘The Rise of BRICS’

There has been a spate of books and articles with the title of ‘The Rise of BRICS’ since its establishment. Vidya Nadkarni and Norma C. Noonan (2013), for instance, devote a collection, Emerging Powers in a Comparative Perspective: The Political and Economic Rise of the BRIC Countries, to the ‘coming power shift’ offering a view sceptical of realist power conflicts among great powers following the recalibration of international power and indicating that the rising BRIC countries while challenging liberal world financial institutions have selectively supported the norms and institutions of a liberal international economic order. This book was written before China’s attainment of great power status and its global leadership initiatives. The rise of the BRICS is often seen as involving a decline in traditional centres of power and heralding a new era in which the BRICS become far more influential in world affairs, reshaping existing world institutions and brokering a multipolar world and multilateral international order.

Carmody’s The Rise of BRICS in Africa: The Geopolitics of South-South Relations concerns the new scramble for Africa as the last frontier of global capitalism. She maintains that BRICS is reshaping global governance and challenging the neoliberal policies of Western powers, opening up a new role for African economies in the development process. Modi and Cheru’s Agricultural Development and Food Security in Africa: The Impact of Chinese, Indian and Brazilian Investments seeks to make sense of BRICS investment in Sub-Sahara Africa and the potential of South-South development for less exploitative relations.

One report, BRICS and the World Order: A Beginner’s Guide, concluded, somewhat prematurely, I would argue, that

Given the divergences among the BRICS, it is highly unlikely that they will be able to create a power bloc that is formidable enough to be a guiding force in the 21st century. What the BRICS can hope for is significant influence that will grow as the group itself institutionalises trust and consolidates. To be a guiding force, there is a need for the convergence of ideas on global governance.

As Andrew Cooper wrote, some five years ago, ‘There is no lack of commentary about the rise – or putative fall – of BRICS. Reflecting the theme of transformation in current public debate, an array of investment professionals, journalists and scholars have made judgements about the phenomenon. However, the bulk of these analyses focus on the economic profile of the BRICS. What has been lacking is a study that highlights not only the economic but diplomatic and geostrategic implications of the BRICS.’ It is clear that a number of geopolitical factors including the Ukraine War, increased US sanctions against Russia and the freezing of Russia’s $330 billion dollar reserves, Biden’s trade and tech wars against China and its extensions into the international financial system, as well as fintech and digital currencies, and the veritable rush of many countries of the Global South to join BRICS, has raised the stakes in a global security environment where many countries in Asia, South America and Africa have adopted a kind of neutrality as the US beats the drums of war, works to encircle China and slow down its growth, and attempts to solidify its pacts with traditional allies in the ‘Indo-Pacific.’ In this new strategically sensitive environment, the position of small states becomes important, not only those like New Zealand but also the Pacific Island states that are wrestling with problems of sea-level rises, by far the most important priority for them, in an era of increased great power rivalry. In this context, soft power and emerging BRICS alliances, such as between China and India at the WTO, become critical for South-South solidarity and global leadership. Emerging rule-breaking, the introduction of economic sanctions and subsidies, and ‘big power’ trade and financial coercion test the resolve of traditional sympathies and can quickly erode old assumptions and understandings, especially in WTO trade disputes and settlements in an international trading system where ‘rule-based order’ begins to shrink and look arbitrary. Accordingly, multilateralism looks vulnerable and easy-to-make rhetoric of ‘democracies’ against ‘autocracies,’ or ‘free market’ vs ‘state capitalism’ belies the struggle to control the politics of world trade narratives.

The New Development Bank

It is in this context of system rivalry and strategic competition that the New Development Bank (NDB) should be examined as it reflects not only their growing economic influence, but it also signifies the desire to shift away from Western-controlled institutions like the World Bank and the International Monetary Fund (IMF) to have a greater say in global finance. As the Congressional Research Service brief ‘Multilateral Development Banks: Overview and Issues for Congress’ notes: ‘The United States is a member, and donor, to five major MDBs: the World Bank and four regional development banks, including the African Development Bank, the Asian Development Bank, the European Bank for Reconstruction and Development, and the Inter-American Development Bank.’ MDBs are basically infrastructure banks devoted to large-scale projects. USD funding to MBDs was cut by $650 million during the Trump years based on criticisms of a lack of US control over spending and some alarm over the launch of two new MDBs led by China. As Amy Dodd reports, the world needs more funds released from MDBs to tackle global challenges. Currently, the world’s 30 MBDs hold over US$1.8 trillion in assets and ‘could lend up to a trillion if they used capital more efficiently.’

The multilateral development system comprised of UN agencies and programmes, MDBs and vertical funds (development financing mechanisms confined to single development domains) – some 200 multilateral development entities since the creation of the UN system – has been under pressure to respond to a growing list of new development challenges and distribute global and regional public goods in the face of growing fragmentation, complexity and geopolitical instability. The multilateral development system, besides direct infrastructure funding, also plays a vital role in ‘facilitating policy dialogue and aid coordination, and providing technical assistance,’ and, while the UN system plays a strong facilitating role, it is still directed and controlled by the largest donors and country elites that use development aid to promote specific reform policies of the Washington consensus and post-Washington consensus that are favourably to the liberal world order.

This is the geopolitical environment within which NDB was established:

NDB aims to mobilise resources for infrastructure and sustainable development projects in BRICS countries and other emerging economies and developing countries to complement the existing efforts of multilateral and regional financial institutions for global growth and development….

NDB has so far approved 70 infrastructure and sustainable development projects worth USD 25.07 billion (including loans under NDB Emergency Assistance Facility) across all the member countries in the past five years. This includes 18 projects of India worth USD 6.9 billion. NDB funds projects in areas such as sustainable infrastructure, clean energy, social safety, public health, education, water, sanitation and flood protection, renewable and green energy, transport, infrastructure, irrigation, agriculture, smart cities, etc.

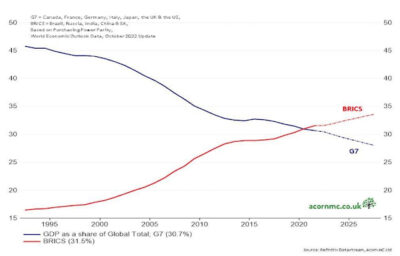

The BRICS countries have been playing an increasingly influential role in the global economy, projected to outstrip G7 combined GDP by 2030. BRICS combined GDP accounts for a significant share of the world economy, and BRICS are expected to play an even larger role in the coming years. BRICS has been working to increase trade among member countries, establish bilateral agreements, and collaborate on various development initiatives, including green sustainability projects, enhanced dialogue on global and regional security, and cultural exchanges.

Figure 2. Projected growth of BRICS GDP to 2030

Egypt ratified its membership in the NDB in 2022 after the admission of Bangladesh, the United Arab Emirates and Uruguay a year earlier, and the Bank has worked in partnership with other MDBs such as the World Bank (WB), African Development Bank (ADB), the China Construction Bank (CCB), the Agricultural Development Bank of China (ADB), the Export-Import Bank of China (EIB), the Brazilian Development Bank (BDB), Development Bank of Southern Africa (DBSA), as well as the Food and Agriculture Organisation (FAO) of the UN, signing over 25 memorandums of understanding with various academic and civil society institutions. The NDB outlines the ‘focus area’ of ‘shaping a sustainable future’ with projects designed to support the transition towards a low-emission development pathway, sustainable transport infrastructure, clean water and sanitation, environmental protection, social and digital infrastructure and COVID-emergency assistance, with 117 funded projects as of 2023. Under ‘social infrastructure,’ for example, the NDB initiated the Teresina Educational Infrastructure Program in Brazil (2020, $US50m), where only 5% of students attend school, the Development of Educational Infrastructure for Highly Skilled Workforce in Russia (2019, $US500m) project, later cancelled, and the Digital Infrastructure, Cellular Network and Cloud Services Expansion Project in Russia (2020, $US300m).

The Bank has encouraged bilateral partnerships between Egypt and Russia, and Egypt and China, shoring up Global South at a time of rising geopolitical tensions. Egypt is the first Middle Eastern nation to receive development assistance from the AIIB, as well as investments under the Belt and Road Initiative. BRICS and the NDB, working together, are able to frame declarations indicating the commitment to multilateralism, sustainable development and global outreach. It is also clear that both the BRICS and NDB present opportunities for China and India to craft narratives about the relationship between global governance and international development, focusing on a fairer and more democratic representation of the Global South in world politics as the basis for a BRICS common agenda.

De-Dollarisation

De-dollarisation refers to the process of reducing reliance on the US dollar in international transactions, reserves, and financial systems. It has gained momentum in recent years due to several factors, including concerns over the volatility of the dollar, efforts to reduce exposure to US financial sanctions, and a desire for greater monetary sovereignty. Russia and China have increased the use of their national currencies in bilateral trade, reducing their dependence on the US dollar. Additionally, several countries have diversified their foreign currency reserves, including holding a larger share in currencies other than the dollar. Russia, in particular, is spearheading the development of a new currency that could be used for cross-border trade. Brazil’s Lula da Silva has repeatedly questioned why countries have to base their trade on the US dollar, and China has been promoting the internationalisation of RMB and trade in local currency. Many commentators have talked up the possibility of a BRIUCS currency, indicating that the moment of de-dollarisation has arrived. The pursuit of de-dollarisation by a variety of means has raised the significance of this diversification away from the dollar, especially in light of the effects of US financial sanctions against Russia freezing its $330b of US dollar reserve. Other countries can see the writing on the wall should they fall out with the US.

Booming trade in energy, raw materials, and military hardware and technology among BRICS countries has also encouraged the removal of trade barriers and the use of national currencies for cross-border trade. The Yuan is the most popular currency in Russia after the Ukraine War started surpassing the USD, and China has been able to trade oil with Saudi Arabia using the Yuan. Most recently, as reported by Vinod Dsouza, ‘India Convinces 22 Countries to Trade in Rupee, Ditch US Dollar’: ‘BRICS member India convinced 22 countries to open special Vostro bank accounts to settle trade in the Rupee for imports and exports. Vostro is a special bank account created specifically for business purposes where domestic Indian banks enable payments from other countries. The banks will allow rupee remittances from overseas, making it easier for other countries to settle trade in INR.’

Mihaela Papa, in her headline for The Conversation, indicates that ‘A BRICS currency is unlikely to dislodge dollar any time soon – but it signifies growing challenge to established economic order.’ She argues as follows:

The BRICS summit comes as countries across the world are confronting a changing geopolitical landscape that is challenging the traditional dominance of the West… With 88% of international transactions conducted in US dollars, and the dollar accounting for 58% of global foreign exchange reserves, the dollar’s global dominance is indisputable. Yet de-dollarisation – or reducing an economy’s reliance on the US dollar for international trade and finance – has been accelerating following the Russian invasion of Ukraine…. Russian officials have been championing de-dollarisation to ease the pain from sanctions. Because of sanctions…. The Chinese government has also clearly laid out its concerns with the dollar’s dominance, labelling it ‘the main source of instability and uncertainty in the world economy.’

Michael Roach is less equivocal: ‘Will a new global reserve currency threaten the greenback’s supremacy? The short answer is yes.’ He goes on to argue:

As the reliance on US dollars diminishes, central banks will begin dumping their dollar reserves. This will result in hyperinflation, a spike in interest rates to compensate for the loss of purchasing power, and falling asset prices, further accelerating US decline. The trend of de-dollarisation is occurring – but it is not something unique.

Roach is referring to the rise and fall of various currencies associated with the colonial great powers of Europe that fluctuated according to the fortunes of empire. Other countries are actively pursuing de-dollarisation, like Indonesia, which is trying to reduce dollar dependency. Indiputera et al. concludes that BRICS countries are attempting to internationalise and diversify their currencies in order to avoid the US dominance of the international trade system increasingly controlled through ‘trade barriers, tariffs, sanctions, and investment’ and other coercive measures that represents a shift away from the ‘rules-based order.’ Yet, as O’Neill notes, threats to the dollar’s dominance in the international system are nothing new, and the eclipse of the dollar would not necessarily be all bad given all the responsibilities facing the world’s main reserve currency in a global economy where the US is declining in importance. In this situation, likely to worsen still further for the US economy relative to emerging countries, ‘Other economies would much prefer that their own currencies, monetary policies, and trade patterns not be so influenced by those of the US’ driven by the Federal Reserve’s domestic policies. Additionally, one might argue that US dollar dominance is assured for some time given the influence of US fintech and the huge power of the US finance houses such as Blackrock, Vanguard and State Street, the three biggest mutual fund companies in the US that managed most of the $21 trillion, equal to all the stocks traded on the NYSE, Arca and NASDAQ.

Yaroslav D. Lissovolik, the editor of a forthcoming special issue for the BRICS Journal of Economics on ‘The Role of BRICS-Plus in Changing the Global Monetary and Financial Architecture,’ makes it clear that a BRICS currency, high on the list of BRICS-related topics, ‘could have transformational implications for the global monetary system, with a notably negative effect imparted on the US dollar’ indicating that the scope for de-dollarisation would be substantial with the creation of a common currency, profiling a substantial role for the NDB especially in the network with regional development banks. These BRICS financial institutions acting in concert ‘could increase in mutual trade and investment among BRICS economies’ based on local currency trading and greater trade liberalisation. A BRICS common currency that might take the form of a digital currency backed by gold could be successfully directly to increasing mutual trade and investment among BRICS economies and making the international financial architecture more user-friendly to BRICS members.

Author’s note

The systematic journal study of BRICS in the West is a recent phenomenon. I have benefitted greatly from reading the BRICS Journal of Economics, BRICS Law Journal, Journal of BRICS Studies and BRICS Business Magazine.

* Maroon = Brazil, Russia, India, China; red = South Africa; blue = ‘Next Eleven,’ i.e. Mexico, Indonesia, South Korea, Turkey (‘MIKT’; navy blue) and Bangladesh, Egypt, Iran, Nigeria, Pakistan, Philippines, Vietnam (light blue).